1. Introduction: The Power of “Three White Soldiers” Pattern

Candlesticks, those little sticks on charts, can tell us stories about where a stock or market might be headed. Today, we’re diving into a special story – the “Three White Soldiers” pattern. Think of it as a signal, like a green light for bulls in the stock market.

Now, what is this “Three White Soldiers” thing? Well, it’s like a team of bullish soldiers marching in, ready to turn the tables. Imagine three strong and tall candlesticks standing in a row, each one closing higher than the last. It’s like a cheer for the bulls, saying, “Hey, it might be our time now!”

When you see this pattern after a downtrend, it’s like a hint that the bears (the sellers) might be taking a break, and the bulls (the buyers) are getting ready to charge in. It’s not a magic wand, though; it’s more like a friendly forecast.

So, stick around as we unwrap the Three White Soldiers pattern, learn its language of candles, and understand why it’s like a beacon of hope for those looking for a trend change in the stock market. Ready for a bullish adventure? Let’s go!

2. Understanding the Three White Soldiers Pattern

The Three White Soldiers pattern is a bullish signal in the world of trading. Imagine this pattern as a trio of friendly soldiers marching together, bringing good news for traders. Let’s break it down.

2.a. Simple Definition

In simple terms, the Three White Soldiers pattern consists of three consecutive candlesticks that are buddies and shine bright. Each candlestick opens within the body of the previous one and closes higher. Think of it like a positive wave building up on the price chart.

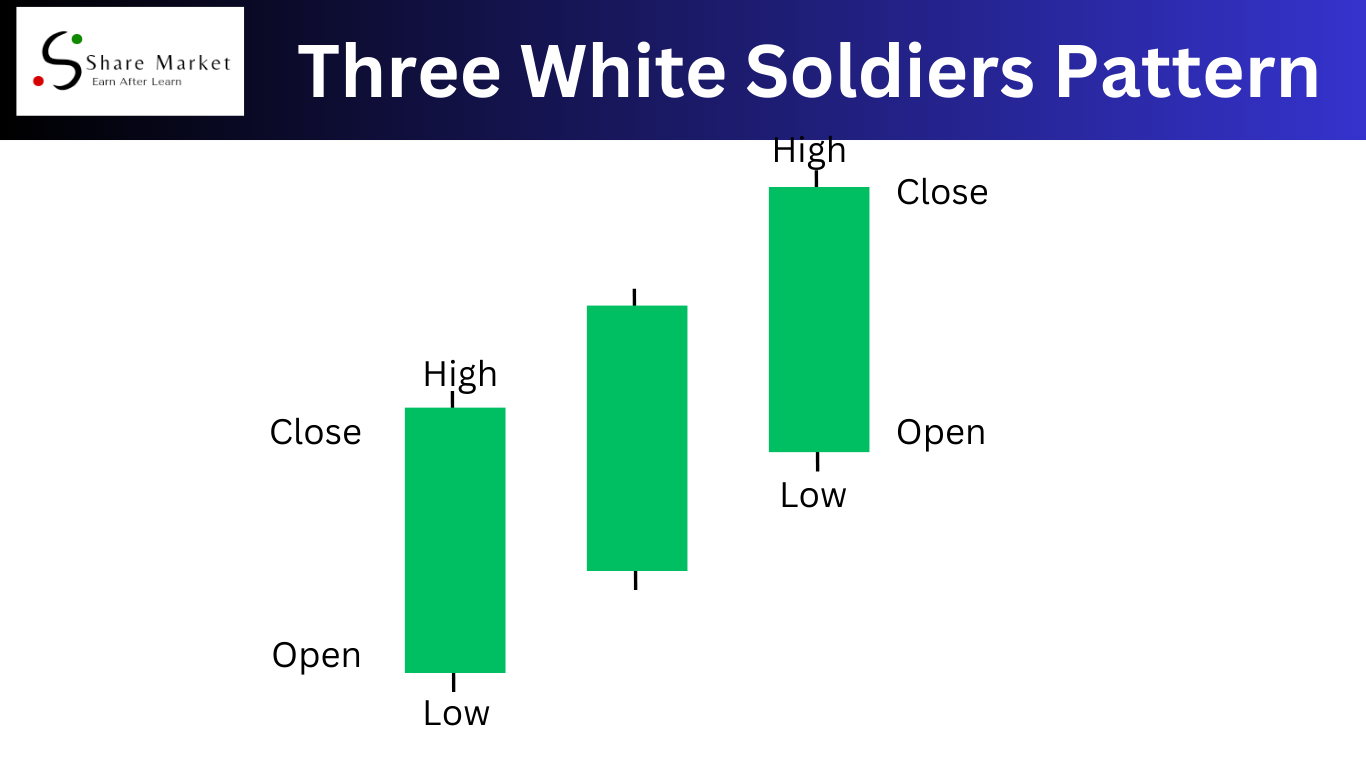

2.b. Visual Representation

Picture the first candlestick as a brave soldier starting the journey with a strong upward move. The second soldier follows, opening inside the first one and closing even higher. The third soldier continues the trend, opening inside the second and closing higher yet again. It’s like a trio of candles marching upwards, signaling a potential turnaround in the market.

2.c. How it Forms During a Downtrend

This pattern typically shows up when the market is feeling a bit down. The first soldier represents the initial push upwards, and as the other soldiers join in, it suggests a shift in sentiment from bearish to bullish. It’s like the soldiers are turning the tide, bringing positivity after a gloomy period.

3. Key Characteristics Three White Soldiers Pattern

When it comes to understanding the Three White Soldiers pattern, simplicity is key. This bullish reversal signal consists of three consecutive candlesticks that bring good news for traders. Let’s break down its key characteristics in plain English.

3.a. Three Consecutive Happy Candlesticks

Imagine three friends walking together – in the world of trading, these friends are represented by three long, green candlesticks. Each one is like a step forward, signaling a potential shift in the market’s mood from gloomy to cheerful.

3.b . Opening Inside the Previous One

Picture these candlesticks as neatly stacked cups. The opening of each new candlestick sits snugly within the previous one’s body. It’s like a friendly handover, suggesting a smooth transition from one phase to the next.

3.c. Going Up, Up, Up

The closing prices of these candlesticks follow a delightful trend – they go higher and higher, like climbing stairs. This upward movement hints at growing confidence among traders, as if they’re saying, “Things are looking up!”

In essence, the Three White Soldiers pattern is like a positive turning point in a story. It’s a trio of signals shouting, “Hey, the bulls might be taking over!” While it’s exciting, remember, no magic guarantees success in trading. Always keep learning and use such patterns wisely.

4. Interpreting the Three White Soldiers Pattern

The Three White Soldiers pattern holds a special place in the world of candlestick analysis, acting as a potential herald of a trend reversal. Let’s unravel its significance and dive into the psychology behind each of its three distinctive candlesticks.

4.a. Significance of the Pattern

This pattern emerges during a downtrend, indicating a shift in market sentiment. The consecutive appearance of three strong bullish candlesticks sends a powerful message – a potential end to the prevailing downtrend. It’s like a trio of optimistic soldiers marching in, challenging the bearish forces and suggesting a newfound strength among the bulls.

5.Understanding the Psychology

5.a. First Soldier:

– Opens within the previous bearish candle’s range, symbolizing the bulls gaining ground.

– Buyers assert themselves, pushing the price upward from the opening.

5.b. Second Soldier:

– Maintains the bullish momentum, opening within the body of the first candle.

– Buyers continue to dominate, signaling increased confidence.

5.c. Third Soldier:

– Completes the triumphant trio, opening within the second candle.

– Strong bullish sentiment persists, closing near the high, sealing the potential reversal.

In the psychology of these candlesticks, a narrative unfolds – a gradual overthrow of bearish control by the bulls. Traders observing this pattern may interpret it as a call to action, considering potential long positions as the tide turns in favor of the bulls.

In essence, the Three White Soldiers pattern is not just a visual arrangement of candles; it’s a storyline of market dynamics, reflecting the evolving battle between bulls and bears. Understanding this narrative equips traders with insights into potential trend reversals, making it a valuable tool in their analytical toolkit.

6. Unlocking the Three White Soldiers: Practical Tips for Trading Success

When it comes to navigating the financial markets, understanding the Three White Soldiers pattern can be a game-changer for beginners. Yet, to make the most of this bullish signal, a couple of key tips can be the compass guiding your trading journey.

6.a Confirmation Signals

To boost your confidence in the Three White Soldiers pattern, keep an eye out for confirmation signals. It’s like having a friend back you up. Look for increased trading volume – more people joining the party can validate the pattern’s strength. Additionally, don’t hesitate to bring in other technical indicators to the mix. Think of it as having multiple arrows pointing in the same direction, reinforcing the pattern’s signal.

6.b. Risk Management

Trading isn’t a walk in the park, and risk management is your protective armor. When working with the Three White Soldiers, set appropriate stop-loss levels. This means deciding beforehand the point where you’ll gracefully exit if the trade doesn’t go as planned. Also, a friendly reminder: don’t put all your eggs in one basket. While the Three White Soldiers is a reliable buddy, don’t get too cozy. Diversify your strategies and be cautious of relying solely on this pattern for all your trading decisions.

7. FAQs About Three White Soldiers Pattern

Q: What is the Three White Soldiers Pattern?

A: The Three White Soldiers Pattern is a bullish sign in trading. It happens when three long, rising candlesticks appear one after the other.

Q: Can the pattern appear on any timeframe?

A: Yes, it can show up on different timeframes, but remember, its meaning might change.

Q: Is it a guaranteed signal of a bullish reversal?

A: No, it suggests a possible reversal, but it’s safer to use it along with other signs for better accuracy.

Q: How long should the candlesticks be for the pattern to be valid?

A: There’s no strict rule, but generally, longer candlesticks make the pattern more reliable.

Q: Can this pattern occur in other markets?

A: Absolutely, you can find the Three White Soldiers pattern in stocks, forex, and other markets.

8. Conclusion

In closing, mastering the Three White Soldiers pattern empowers traders with a valuable bullish signal. Yet, success hinges on a balanced strategy, combining pattern recognition, volume analysis, and risk management. Keep learning, stay vigilant, and let the Three White Soldiers guide you in navigating the markets.

I hope that after reading this article, you have gained a lot of knowledge. If you want to learn more about trading, you can visit this website (www.sharemarketdo.com) and learn for free.