1. Introduction

The Piercing Patterns is like a superhero signal in the world of trading charts. Imagine it as a knight in shining armor for traders, showing up when the market is down and ready to turn things around.

So, what exactly is this Piercing Pattern? It’s a two-candlestick formation where the first day shows a downtrend, feeling a bit gloomy. But here comes the exciting part: the second day opens lower than the first day’s close, setting the stage. Then, like a sudden burst of sunlight, the second day closes way above the midpoint of the first day’s body.

Why does this matter? Well, the Piercing Pattern is like the market’s way of saying, “Hey, the bulls are waking up!” It suggests a potential shift from a bearish mood to a more optimistic one. Traders often keep an eye out for this pattern as it can be a sign that better days might be ahead.

In a nutshell, the Piercing Pattern is a positive twist in the candlestick story, indicating a possible trend reversal. It’s like a flicker of hope in the trading world, and understanding it could be your secret weapon in navigating the ups and downs of the market.

2. Piercing Pattern: A Simple Guide to Bullish Reversals

The Piercing Pattern is a powerful tool in the world of trading, signaling a potential shift from a downtrend to an uptrend. Let’s break down this pattern into simple terms.

A. Formation:

Imagine two consecutive days on a stock chart. On the first day, there’s a strong downtrend. The second day starts with a continuation of this trend but takes a turn. The opening price is lower than the previous day’s closing, but suddenly, things change. The bulls step in, and the price rises significantly, closing higher than the midpoint of the first day’s candle.

B. Components and Structure:

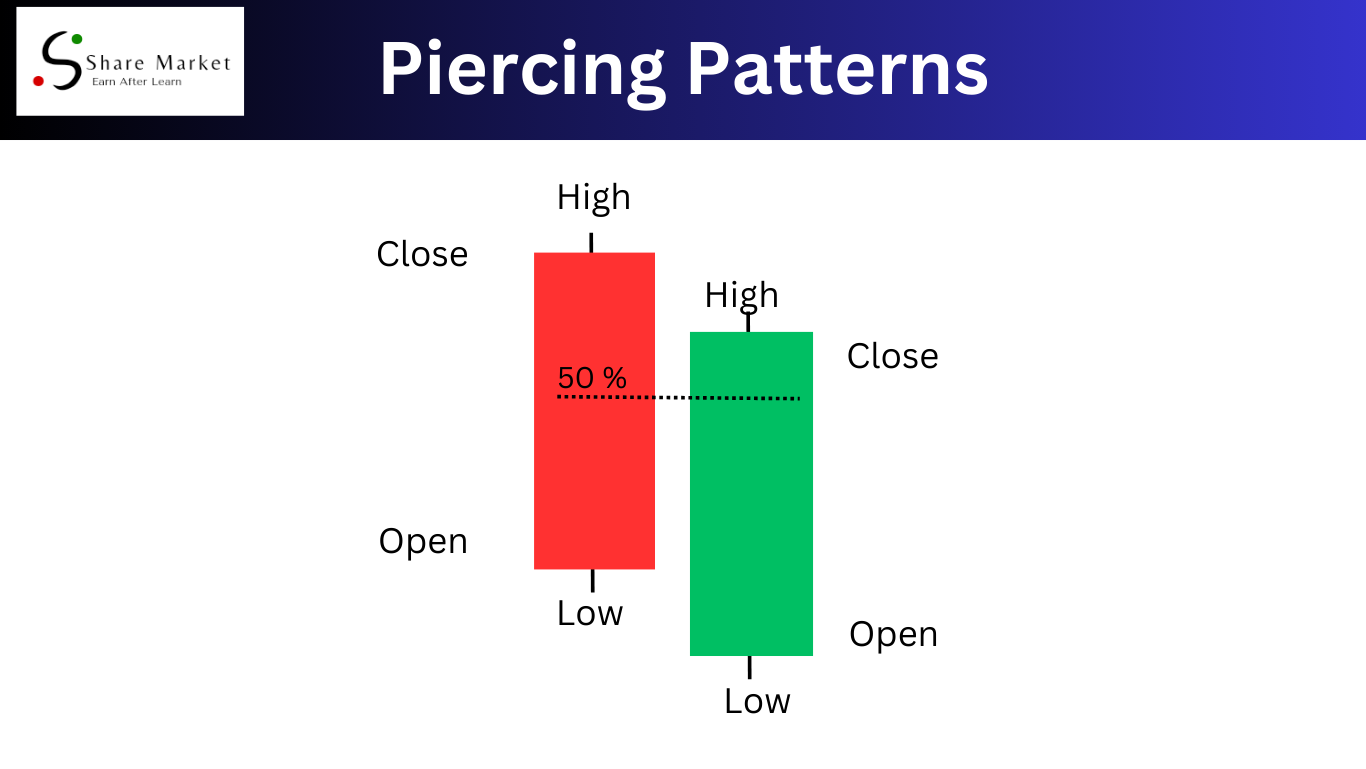

The Piercing Pattern consists of two candles. The first is a bearish (falling) candle, representing the initial downtrend. The second is a bullish (rising) candle that opens lower than the previous day’s close but closes higher than the midpoint of the first day.

C. Bullish Reversal Signal:

This pattern is like a market U-turn. It suggests that after a period of falling prices, the bulls are gaining strength, potentially reversing the trend. It’s a visual cue that the buyers are taking control, making it a moment worth noting for traders seeking opportunities.

In essence, the Piercing Pattern is a simple yet significant signal, indicating a potential bullish comeback in the market. Understanding its formation and structure can empower traders to make informed decisions in the dynamic world of finance.

3. How to Identify a Piercing Pattern

To spot a Piercing Pattern on a price chart, follow these simple steps:

A. Observe the Trend:

– Look for a prevailing downtrend in the market.

B. Locate the First Candle:

– Identify a large red (bearish) candle, signaling the current downward trend.

C. Look for Confirmation:

– The next day, watch for a candle that opens lower than the previous day’s close but closes more than halfway up the prior candle.

D. Check Candle Colors:

– The second candle should be green (bullish), showing a shift in momentum.

E. Assess Market Sentiment:

– The Piercing Pattern suggests potential buyer strength, aiming to reverse the downtrend.

Visual Representation

Below is a simple example:

Understanding these steps and recognizing the pattern on your charts can empower you to make informed trading decisions. Keep in mind that it’s essential to consider other factors and use Piercing Patterns in conjunction with additional analysis for a well-rounded approach to trading.

4. Trading with Piercing Patterns: Simple Strategies for Success

Unlock the potential of Piercing Patterns with these straightforward trading tips. When you spot a Piercing Pattern on your chart, consider these strategies for making informed decisions. First, look for confirmation from other technical indicators to strengthen your analysis. Combine Piercing Patterns with tools like Moving Averages or Relative Strength Index (RSI) for a more robust strategy.

Risk management is crucial. Set clear stop-loss orders to protect your investments and stick to them. Don’t forget to diversify your portfolio to spread risk. Patience is key—wait for confirmation and avoid impulsive decisions. These simple yet effective strategies can enhance your trading with Piercing Patterns, turning them into powerful tools for success.

5. Common Mistakes to Avoid: Navigating Piercing Patterns with Care

One common mistake when dealing with Piercing Patterns is misunderstanding their significance. Traders may sometimes misinterpret a potential bullish reversal, leading to misguided decisions. A pitfall is expecting instant results; Piercing Patterns signal a potential shift, but patience is key.

Guidance on avoiding misinterpretation involves considering the broader market context. Sometimes, isolated patterns may not hold weight, so it’s essential to look at the bigger picture. Additionally, relying solely on Piercing Patterns without corroborating indicators can be risky. Understanding that no signal is foolproof helps traders make informed choices.

In conclusion, while Piercing Patterns can be powerful, caution is crucial. By avoiding hasty conclusions and considering the broader market landscape, traders can harness the potential of Piercing Patterns more effectively in their decision-making process.

6. FAQ about Piercing Patterns

Q1: What does it mean when a Piercing Pattern forms?

When a Piercing Pattern forms on a price chart, it signals a potential shift in the market from a downtrend to an uptrend. Think of it like a green light for bulls, suggesting that the sellers might be losing control, and buyers are gaining strength.

Q2: How reliable is the Piercing Pattern in predicting price movements?

The Piercing Pattern is a helpful tool, but like any indicator, it’s not foolproof. It provides a strong indication of a bullish reversal, but market conditions can vary. It’s essential to consider other factors and not rely solely on this pattern.

Q3: Are there specific timeframes where Piercing Patterns are more effective?

Piercing Patterns can be effective on various timeframes, but their impact may vary. Traders often find them more reliable on longer timeframes, such as daily charts. It’s wise to experiment and see what works best for your trading style and preferences.

7. Conclusion

In conclusion, Piercing Patterns are like little clues that can help us understand where the market might be headed. Remember, a Piercing Pattern is formed when the market is trying to switch from going down to going up. It’s like a sign saying, “Hey, things might get better soon!”

To sum it up, we learned that a Piercing Pattern has two main parts – the first day where prices go down, and the second day where prices bounce back up. This little pattern can be a handy tool in technical analysis, helping us spot potential moments when the market might turn more positive. It’s not a crystal ball, but it’s like a friend giving you a heads-up.

So, when you see a Piercing Pattern, think of it as a positive signal in the world of trading, telling you that a change might be on the horizon. Keep your eyes open, use it wisely, and happy trading!

I hope that after reading this article, you have gained a lot of knowledge. If you want to learn more about trading, you can visit this website (www.sharemarketdo.com) and learn for free.”