Table of Contents

Introduction:

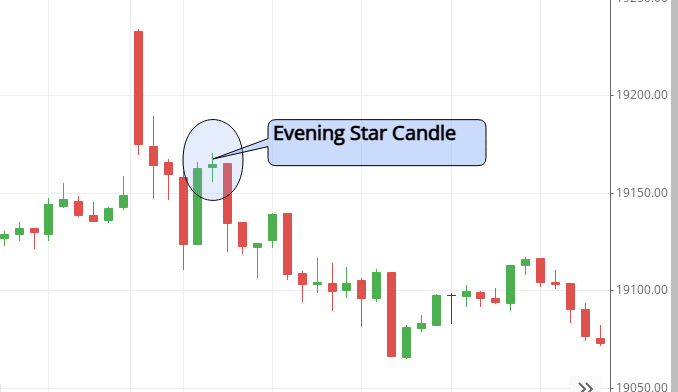

Candlestick patterns are the ancient language of the financial markets, revealing crucial information about market sentiment and potential price movements. Among these patterns, the Evening Star candle stands out as a key indicator of a potential trend reversal. In this article, we’ll unravel the mystery of candlestick patterns, providing a comprehensive guide to understanding, identifying, and trading using the Evening Star candle

Explanation of Candlestick Patterns:

Before diving into the specifics of the Evening Star, let’s establish a foundation by understanding the broader concept of candlestick patterns. These visual representations of price movements offer insights into market psychology, helping traders make informed decisions.

Brief Overview of the Evening Star Candle Pattern:

The Evening Star candle pattern is a powerful tool for traders seeking signs of a potential downturn in the market. Its distinctive formation provides a clear signal for those who know how to interpret it. Now, let’s delve into the details of this intriguing pattern.

What is the Evening Star Candle Pattern?

Definition of the Pattern:

The Evening Star is a three-candle pattern that typically forms at the peak of an uptrend. It signals a potential reversal of the prevailing trend, transitioning from bullish to bearish sentiment.

Characteristics of the Pattern:

Identifying the Evening Star involves recognizing specific features in the three consecutive candles – the uptrend candle (usually large), the gap-up candle, and the downtrend candle.

How to Identify the Pattern:

Understanding the visual cues and key elements of the Evening Star pattern is essential for successful identification. We’ll explore the process of spotting this pattern amidst the market fluctuations.

How to Trade Using the Evening Star Candle Pattern:

Once armed with the knowledge of the Evening Star pattern, traders can implement effective strategies for making informed decisions. This section covers various trading strategies and essential aspects of risk management. See The video to undaerstand the candle in detail

Trading Strategies:

Explore proven strategies for leveraging the Evening Star pattern, including entry and exit points, trend confirmation, and combining with other indicators for enhanced precision.

Risk Management:

Successful trading is not just about making profits but also about managing risks. Learn how to mitigate risks associated with trading based on the Evening Star candle pattern. live example

Frequently Asked Questions (FAQs):

*What is the Difference Between the Morning Star and the Evening Star Candle Patterns?*

Distinguish between these two significant candlestick patterns, understanding their unique formations and the implications they carry for traders.

How Reliable is the Evening Star Candle Pattern?

Evaluate the reliability of the Evening Star pattern by exploring historical data and understanding the conditions that influence its effectiveness.

What are Some Common Mistakes to Avoid When Trading with the Evening Star Candle Pattern?

Navigate the potential pitfalls of trading with the Evening Star by learning from common mistakes and adopting a proactive approach to risk management.

Conclusion:

In conclusion, the Evening Star candle pattern serves as a valuable tool for traders navigating the dynamic world of financial markets. Armed with the knowledge gained from this guide, you’re better equipped to interpret market signals, make informed trading decisions, and navigate the complexities of the trading landscape. As with any trading strategy, continuous learning and adaptability are key to success. Happy trading!

I hope you’ve learned a lot from this blog. If you want to continue learning, visit www.sharemarketdo.com. There, you can learn about the stock market in detail. Keep learning!