Table of Contents

1. Introduction

Welcome to the world of trading! Imagine it like solving puzzles. Today, we’ll talk about one puzzle piece: the Flag Pattern. It’s a powerful tool. Think of it as a pause button in a trend, followed by a restart. We’ll keep it simple, like connecting dots. Let’s understand what it is and why it matters in easy terms. Ready to unravel the mystery of Flag Patterns and make smarter trading decisions?

2. Definition of Flag Pattern

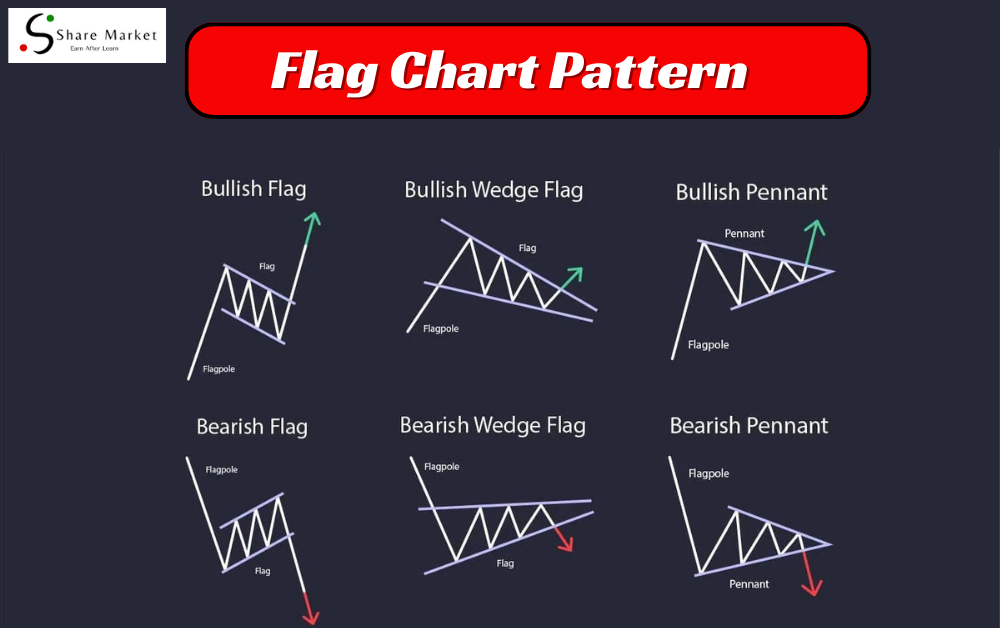

The Flag Chart Pattern is like a signal in trading. Imagine a flag on a pole – that’s how it looks on a price chart. It pops up after a strong price change, suggesting a short break before the trend continues. The flagpole is the first big move, and the flag itself is a small, rectangle-shaped rest. Traders use this pattern to guess if the trend will keep going. It’s like a hint for when to buy or sell. Imagine it as a helpful picture that shows how the market is acting, helping you make smart decisions in trading. So, when you spot a flag on the chart, it’s like the market giving you a clue about what might happen next!

3. Importance of Flag Chart Pattern in Trading

In trading, Flag Chart Pattern act like clues for smart decisions. When you see a Flag Pattern, it’s like the market taking a quick breath before continuing its journey. Traders pay attention because it helps predict where prices might go next, making it a handy tool for successful trading.

4. How to Identify Flag Chart Pattern

Finding a Flag Chart Pattern is like spotting a special shape on a map. Search for a rectangle, like a flag, after a big price move. The tall part is the flagpole, and the rectangle is the flag. It signals a brief pause before the trend keeps going. A helpful guide for smart trading!

4.1 Characteristics of Flag Pattern

A Flag Chart Pattern looks like a rectangle on a chart, similar to a flag on a pole. It appears after a strong price move, signaling a quick break before the trend restarts. Traders notice this shape to make smart choices about buying or selling, helping them understand the market’s next moves.

4.2 Spotting Flag Patterns on Charts

Finding Flag Patterns on charts is like spotting a special shape. Look for a rectangle, like a flag on a pole, after a big move. The pole shows the first jump, and the flag is a quick rest. This helps traders predict if the trend will keep going, making it a useful tool. Practical tips on identifying Flag Patterns in real-world trading scenarios.

5. Criteria for Identifying Flag Pattern

To spot a Flag Chart Pattern, look for a strong climb (flagpole) on a chart. Then, see a rectangle (flag) after the climb, slightly slanting. Check that volume drops during the flag and rises when the trend resumes. Patience is key; wait for a confirmed breakout. This simple checklist helps identify Flag Patterns for smart trading decisions.

6. Examples of Flag Chart Pattern

Concrete examples make learning easier. We’ll walk you through real market examples of Flag Chart Pattern to reinforce your understanding.

7. How to Trade Flag Chart Pattern

Trading the Flag Pattern involves using its unique characteristics to make informed decisions. Once identified, consider the following steps:

7.1. Entry and Exit Points:

- Enter the trade when the price breaks out of the flag.

- Set a target for profit and a stop-loss to manage risk.

7.2. Risk Management:

- Determine the amount of capital at risk for each trade.

- Use risk-reward ratios to maintain a balanced approach.

Remember, the Flag Chart Pattern suggests a potential continuation of the trend. Timing entry and exit points, along with effective risk management, can enhance your trading strategy. Keep a watchful eye on market movements for optimal decision-making based on the Flag Pattern.

8. Trading Strategies for Flag Chart Pattern

Crafting effective trading strategies for Flag Patterns is like having a game plan in a chess match. Traders can approach Flag Patterns in two ways: as a continuation pattern or a reversal pattern.

8.1. Continuation Patterns:

Follow the Trend: If the initial move was upward, anticipate the trend to persist after the flag consolidation.

Entry and Exit Points: Time your trades by entering near the end of the flag and exiting when the trend resumes.

8.2. Reversal Patterns:

Expect a Change: If the initial move was downward, prepare for a potential reversal in the trend after the flag consolidation.

Confirm with Indicators: Use additional indicators like RSI or MACD for added confirmation before making decisions.

9. Tips for Trading Flag Chart Pattern

Trading Flag Patterns is like following a map. Stick to the trend, check for strong volumes, and be patient for clear signals. Set realistic goals, use stop-loss orders, and consider broader market conditions. Think of these tips as your compass for navigating the trading journey with Flag Patterns..

10. Frequently Asked Questions (FAQs)

10.1. What is the Difference Between Flag Pattern and Pennant Pattern?

Flag and Pennant Patterns share similarities, both indicating a pause in a trend. The main difference lies in their shapes. Flags are rectangular, while pennants are small symmetrical triangles.

10.2. What is the Significance of Volume in Flag Chart Pattern?

Volume adds credibility to Flag Patterns. Higher volume during the flagpole and a decrease during the flag suggest a stronger potential continuation of the trend.

10.3. How Reliable is Flag Pattern in Predicting Price Movements?

Flag Patterns are reliable, but confirmation is key. Waiting for a breakout ensures a more robust prediction of future price movements.

11. Conclusion

To sum up, Flag Patterns are like trading road signs. They signal a short break before the market continues. Understanding their importance and spotting them on charts is your trading superpower. Remember, be patient, check the volume, and set clear goals. These tips act as your compass. So, whether you’re new or experienced, using Flag Patterns in trading guides you to smarter decisions. Embrace these patterns, and may your trades wave in the direction of success! Happy trading!

I hope that after reading this article, you have gained a lot of knowledge. If you want to learn more about trading, you can visit this website (www.sharemarketdo.com) and learn for free