Introduction

Welcome to the exciting world of trading, where patterns in charts can be like a secret code revealing potential opportunities. One such code is the “Bullish Flag Pattern,” a dynamic tool for traders looking to ride the waves of an uptrend. In this comprehensive guide, we’ll explore the intricacies of this pattern, from its definition to practical strategies for implementation.

Definition of the Bullish Flag Pattern

2.1 Brief Explanation of the Pattern’s Significance

The Bullish Flag Pattern is not just another shape on a chart; it’s a signal, a signpost in the market indicating a short-term consolidation before the price resumes its upward journey. Think of it as a breather for the bulls, a moment of pause before the next charge.

Characteristics

3.1 Description of the Pattern’s Appearance

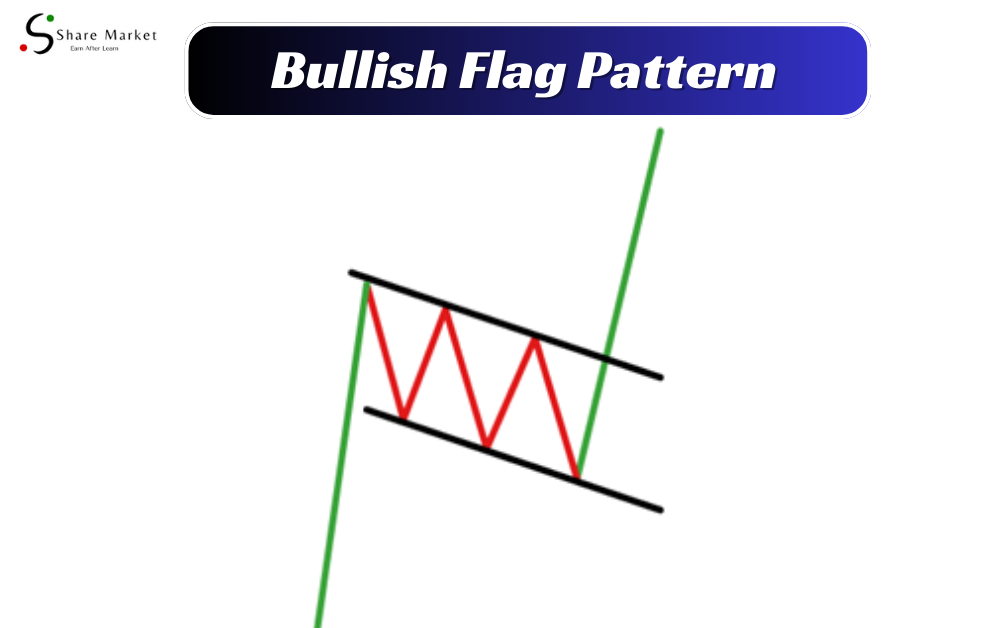

Picture this: a short downward consolidation, followed by a sharp rise in price. The Bullish Flag Pattern takes the form of a narrowing triangle or rectangle. It’s like a visual cue, telling traders that the market is taking a moment to gather momentum for the next surge.

3.2 Explanation of the Pattern’s Formation

Understanding the Bullish Flag Pattern goes beyond recognizing shapes. It’s about decoding market psychology. Discover why this pattern occurs and how it reflects a collective decision among traders to lock in their positions.

Advantages and Disadvantages of the Pattern

4.1 Advantages of Using the Bullish Flag Chart Pattern in Trading

Why should you pay attention to the Bullish Flag Pattern? Uncover its advantages, from easy identification on charts to reliable signals in uptrends. This section will highlight why traders often turn to this pattern in their pursuit of profitable opportunities.

4.2 Disadvantages of Using the Bullish Flag Chart Pattern in Trading

No strategy is without its pitfalls. Involve into the potential drawbacks of the Bullish Flag Pattern, especially on smaller timeframes. Learn how to navigate through false signals and understand why patience is key when dealing with this pattern.

How to Identify the Bullish Flag Chart Pattern

5.1 Explanation of the Steps Involved in Identifying the Pattern

Let’s get practical. Learn the step-by-step process of identifying the Bullish Flag Chart Pattern on your charts. From recognizing the initial consolidation to confirming the breakout, this section provides a roadmap for traders.

5.2 Examples of the Pattern in Real-World Trading Scenarios

Theory meets reality. Explore real-world examples of the Bullish Flag Pattern in action. See how this pattern played out in different market scenarios and gain insights into the decision-making process.

Bullish Flag vs. Bearish Flag

6.1 Comparison of the Bullish Flag Chart Pattern with the Bearish Flag chart Pattern

There’s a Yin to every Yang. Compare the Bullish Flag Pattern with its counterpart, the Bearish Flag Pattern. Understand the nuances that make them distinct and learn when to apply each in your trading strategy.

6.2 Explanation of the Differences Between the Two Patterns

Dive deeper into the differences between these two flag patterns. Grasp the subtle variations in market sentiment that these patterns reveal and discover why recognizing these differences is crucial for effective decision-making.

How to Use the Bullish Flag Chart Pattern in Trading

7.1 Explanation of the Best Strategies for Using the Bullish Flag Chart Pattern in Trading

Knowledge is power, but application is key. Unearth practical strategies for leveraging the Bullish Flag Pattern in your trading endeavors. From entry and exit points to risk management, this section equips you with actionable insights.

7.2 Tips for Maximizing Profits While Minimizing Risks

Trading is a balancing act. Learn valuable tips for maximizing profits while minimizing risks when incorporating the Bullish Flag Pattern into your strategy. Discover how to navigate the unpredictable waters of the market with confidence.

Conclusion

8.1 Summary of the Key Points Discussed in the Blog Post

In this journey through the Bullish Flag Pattern, recap the key takeaways. From its definition to practical applications, ensure you’ve grasped the essentials to incorporate this pattern into your trading toolkit.

8.2 Final Thoughts on the Bullish Flag Pattern

Wrap up your learning experience with final reflections on the Bullish Flag Pattern. Consider its role in the broader landscape of trading strategies and contemplate how it aligns with your individual approach.

Frequently Asked Questions (FAQs)

9.1 Q: What is the Bullish Flag Pattern?

A: The Bullish Flag Pattern is a classic uptrend continuation pattern that signals a short-term consolidation before the price continues to rise.

9.2 Q: How Do You Identify the Bullish Flag Pattern?

A: The Bullish Flag Pattern is identified by a short downward consolidation, followed by a sharp rise in price. The pattern looks like a narrowing triangle or rectangle, which demonstrates the decrease in volumes and indicates that market participants are locking in their positions.

9.3 Q: What Are the Advantages of Using the Bullish Flag Pattern in Trading?

A: The Bullish Flag Pattern is easily identified in the chart, and it’s easier to find entry and exit points than in other chart patterns. The pattern occurs on all markets and is a reliable trade signal when found in an uptrend.

*9.4 Q: What Are the Disadv vantages of Using the Bullish Flag Pattern in Trading?*

A: The Bullish Flag Pattern is easily identified in the chart, and it’s easier to find entry and exit points than in other chart patterns. The pattern occurs on all markets and is a reliable trade signal when found in an uptrend.

9.4 Q: What Are the Disadvantages of Using the Bullish Flag Pattern in Trading?

A: On smaller timeframes, the pattern may show false bullish breakouts, and the flag may take a long time to form.

I hope that after reading this article, you have gained a lot of knowledge. If you want to learn more about trading, you can visit this website (www.sharemarketdo.com) and learn for free.