Table of Contents

1. Introduction:

Candlestick patterns are like a secret language of the stock market, revealing hidden messages about price movements. Among these, the Marubozu candlestick stands out. Imagine it as a storyteller – a candlestick with no upper or lower shadows, signaling a strong trend.

The Marubozu is a special character in this financial storybook. It speaks of powerful market sentiment, whether bullish or bearish, without any indecision. Understanding the Marubozu is like having a key to deciphering market dynamics in a single glance.

In the world of technical analysis, grasping the Marubozu’s language is crucial. It gives traders and investors a clearer picture of where the market might be heading. In just a few simple lines on a chart, the Marubozu communicates a wealth of information. Let’s unravel the mystery and discover why this candlestick is a valuable tool in the realm of stock market analysis.

2. What is a Marubozu Candlestick?

A Marubozu candlestick is a special chart pattern used in financial markets to understand price movements. Let’s break it down:

2.A. Definition and Origin:

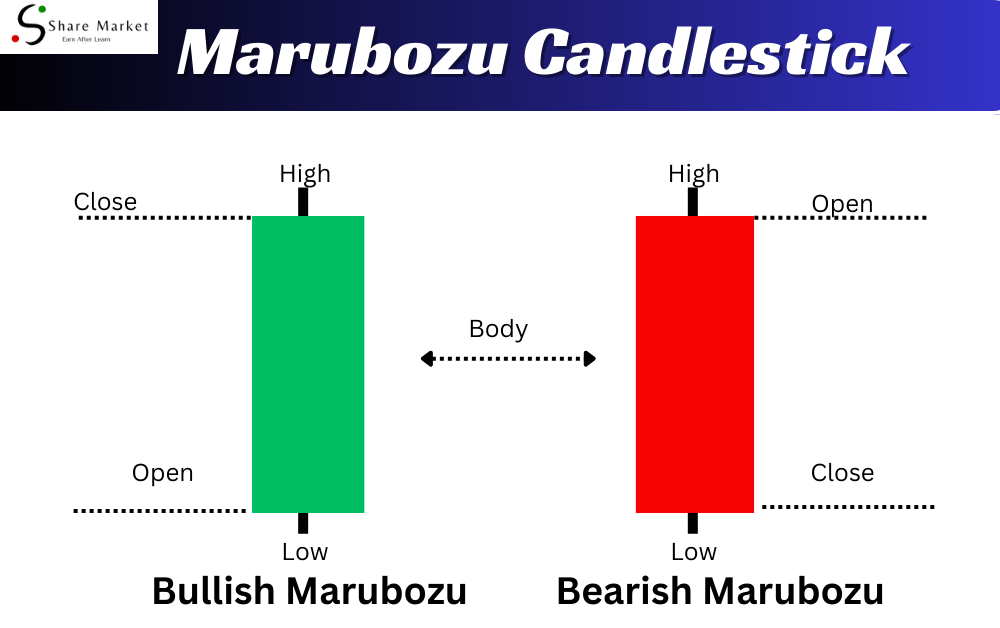

A Marubozu is a candlestick with no upper or lower shadows, meaning it has a solid body from top to bottom. The term “Marubozu” comes from Japanese, where it means “bald” or “shaved,” signifying the absence of shadows.

2.B. Characteristics of a Marubozu Candlestick:

A. 1. Absence of Shadows:**

Unlike regular candles, Marubozu candles have no lines sticking out at the top or bottom.

A.2. Different Types

Bullish and Bearish:** There are two main types of Marubozu. A bullish Marubozu has a solid body at the top, suggesting a strong upward trend. In contrast, a bearish Marubozu has a solid body at the bottom, indicating a strong downward trend.

2.C. How Marubozu Reflects Market Sentiment:

The Marubozu pattern gives us a quick snapshot of what traders are feeling. A bullish Marubozu shows strong optimism, while a bearish one indicates significant pessimism. It’s like a mood ring for the market, helping traders understand the overall sentiment.

In essence, Marubozu candlesticks simplify complex market movements, making it easier for traders to make informed decisions based on prevailing emotions in the market.

3.A. Bullish Marubozu:

A.1. Characteristics and Appearance:

A bullish Marubozu is a special candlestick with no shadows, showing only a solid body. It opens at the low and closes at the high, indicating strong buying throughout the entire trading period.

A. 2. Interpretation:

Bullish Marubozu suggests strong buyer control, signaling potential upward momentum. Traders often see this as a positive sign for further price increases.

3.B. Bearish Marubozu:

B.1. Characteristics and Appearance:

A bearish Marubozu also lacks shadows but opens at the high and closes at the low. This indicates sustained selling pressure throughout the trading period.

B.2. Interpretation:

Bearish Marubozu signals strong seller dominance, suggesting potential downward momentum. Traders may interpret this as a sign to consider selling or taking a cautious approach.

3.C. Comparison:

Bullish vs. Bearish:

The key difference lies in the opening and closing prices. Bullish Marubozu opens low and closes high, while bearish Marubozu opens high and closes low. Understanding these distinctions helps traders assess market sentiment and make informed decisions.

In summary, recognizing these simple characteristics can provide valuable insights into market trends and assist traders in making more informed decisions based on the prevailing buyer or seller strength.

4. How to Spot and Understand Marubozu on a Chart

When checking a chart, focus on candlesticks with no upper or lower shadows – that’s a Marubozu! If it’s fully filled, it’s a bearish Marubozu, indicating a strong downtrend. If it’s empty, it’s a bullish Marubozu, signaling a strong uptrend. Look for these near trend changes; a bullish one might mean a continuing upward trend, while a bearish could hint at a downtrend. Keep an eye on these simple shapes—they speak volumes about where the market might be headed!

5. Frequently Asked Questions (FAQ)

Q. What does a Marubozu indicate in technical analysis?

A Marubozu signals strong market sentiment. A bullish one suggests strong buying, while a bearish indicates intense selling.

Q. How reliable is Marubozu as a signal?

Marubozu is a robust signal, especially in trending markets. Its reliability increases when supported by other indicators.

Q. Can Marubozu candlesticks be used in isolation for trading decisions?

While Marubozu offers valuable insights, it’s wise to consider other indicators or patterns for a more comprehensive trading strategy.

Q. Are there specific timeframes where Marubozu is more effective?**

Marubozu works on various timeframes, but its effectiveness may vary. Testing on different timeframes is advisable.

Q. What other indicators or patterns should be considered alongside Marubozu?**

Combine Marubozu with indicators like Moving Averages or RSI for more accurate trading signals. Use it as part of a well-rounded analysis.

6. Tips for Successful Marubozu Trading

A. Keep it Real: Set Realistic Expectations

Understanding Marubozu’s signals can be powerful, but don’t expect miracles. Set achievable goals based on market conditions and your experience.

B. Play it Safe: Use Effective Risk Management

Control risks by setting stop-loss orders. This protects your investment from unexpected market shifts, ensuring that a single trade won’t break the bank.

C. Blend with the Big Picture: Include Marubozu in Your Overall Strategy

Don’t rely solely on Marubozu. Integrate it into your broader trading plan, combining it with other indicators for a well-rounded strategy that maximizes your chances of success.

7. Real-life Examples

A. Success Stories with Marubozu

Discover how traders capitalized on Marubozu signals. From confident market entries to well-timed exits, these real-life case studies showcase the effectiveness of Marubozu in predicting price movements.

B. Learning from Mistakes

Explore examples of false signals, where Marubozu didn’t perform as expected. Learn valuable lessons from these instances, empowering you to make informed decisions and avoid potential pitfalls in your own trading journey.

8. Conclusion

In summary, Marubozu candlesticks are special because they show strong market sentiment with no shadows. Whether bullish or bearish, they offer clear signals for traders. It’s crucial to include Marubozu in your overall trading plan for better decision-making. Understanding these candlesticks helps predict potential changes in the market. In simple terms, they’re like road signs guiding you through the trading journey. So, remember to keep an eye on Marubozu patterns—they might just be the key to making more informed and successful trades!

I hope that after reading this article, you have gained a lot of knowledge. If you want to learn more about trading, you can visit this website (www.sharemarketdo.com) and learn for free